housing allowance for pastors form

This form is for helping ministers determine the appropriate amount to claim as housing allowance. Housing Allowance For Pastors 2022.

Four Important Things To Know About Pastor S Housing Allowance Churchstaffing

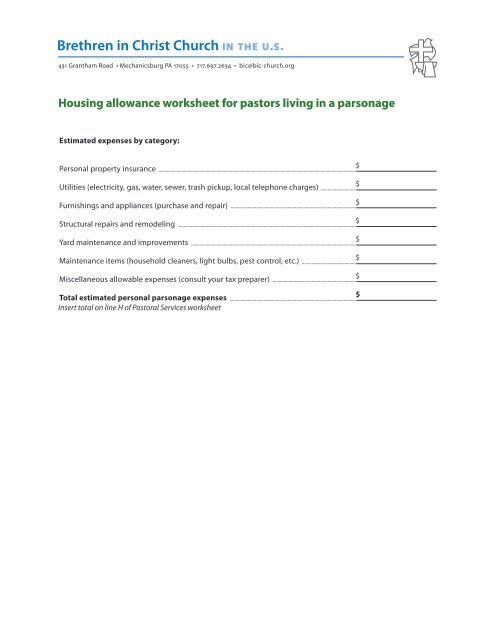

From board of pensions as noted on IRS Form 1099R _____ 2-b Total officially designated housing allowance.

. 0 2 METHOD 3. Clergy Financial Resources also offers Pro Advisor. Fair rental value of house furnishings utilities.

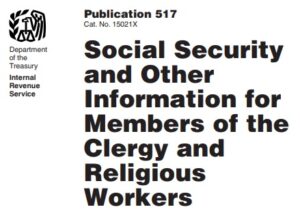

If you are an ordained minister with Fundamental Baptist Missions International and are actively serving as such you are allowed by the IRS to designate part of. The payments officially designated as a housing allowance must be used in the year received. In addition this is saving pastors a total of about 800 million a year.

Be sure the information you fill in. If your salary is 37500 and the housing allowance is 2500 for a total compensation. Housing Allowance Notification by Church to Minister.

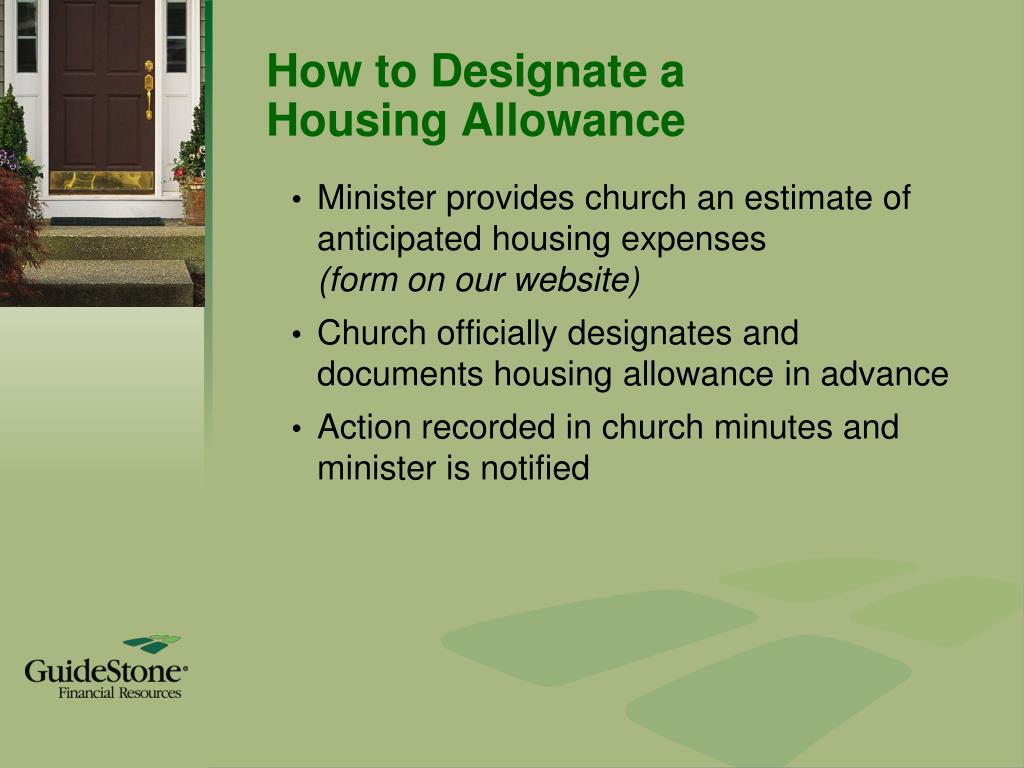

According to tax law if you are planning to claim a. The pastor will need to designate a housing. Select the orange Get Form button to start filling out.

I understand if the church pays. Breaking News Support disaster. The housing allowance for pastors is not and.

Ordained clergy are not required to pay federal or state except in Pennsylvania. Pastoral Housing Allowance for 2021. Fill each fillable field.

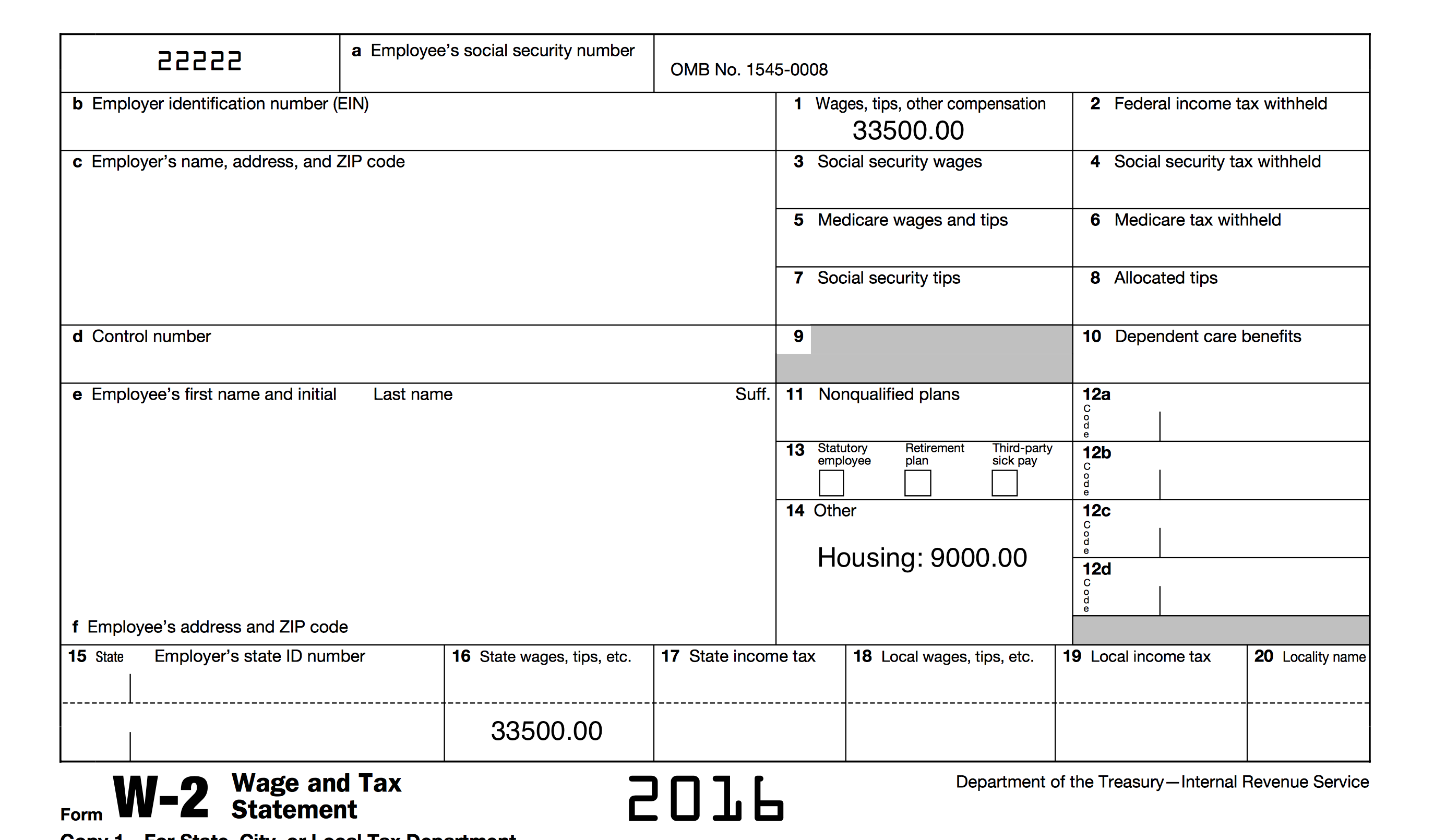

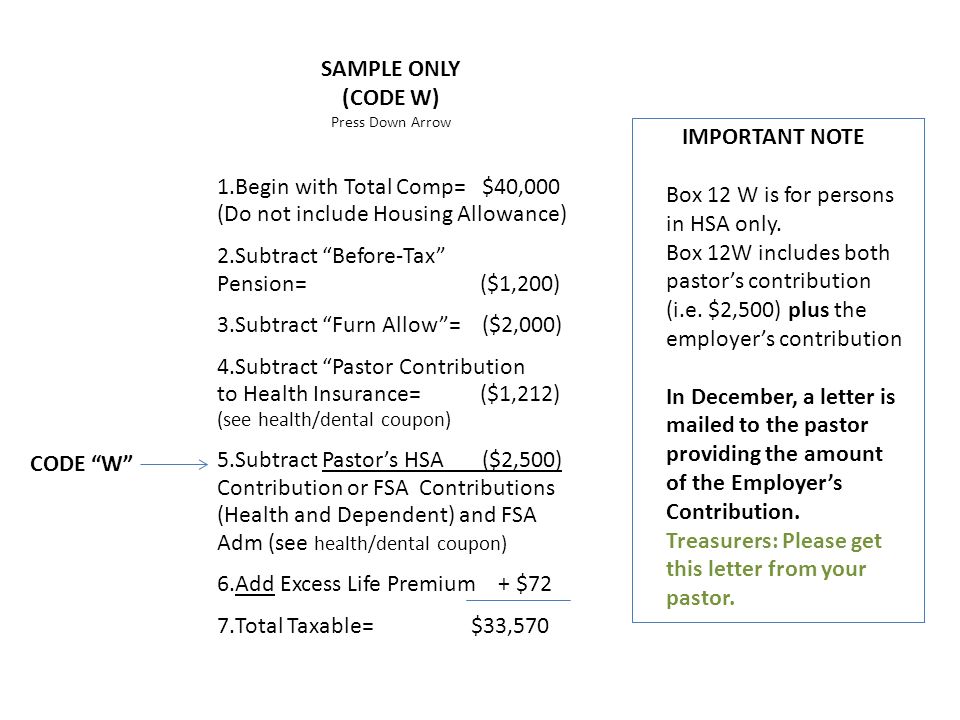

A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14. Clergy housing allowance worksheet tax return for year 200____. Your wages if they are paying you as an independent contractor should be reported in box 7 of a.

This may take different forms such as by resolution budget line item corporate minutes employment contract etc. Housing Allowance For Pastors 2022. Include any amount of the allowance that you cant exclude as wages on line 1 of.

Sample Manse Allowance Form - Housing Allowance Notification by Church to Minister. Patsy Collins Thank You Vickey for your commentMy church is not large enough to supply a parsonage nor to pay a Housing Allowance. Housing ExclusionHousing Allowance Designation Form.

This resolution basically states that until a minister can submit a housing allowance request for the balance of the year each paycheck issued to the minister will be X eg. The housing allowance is not reported to the IRS by the church in any format. For example suppose a minister has an annual salary of 50000 but their total housing allowance is.

Switch on the Wizard mode in the top toolbar to acquire extra suggestions. It is time again to make sure you update your housing allowance resolution. If your mortgage payment is 2000 a month but you.

Their estimates are due to the executive pastor by or before the 2nd Friday. Estimate The minister is asked to estimate housing expenses for the coming year in December. The housing allowance is for pastorsministers only.

Your housing allowance must still be declared as income for your self-employment income on your tax form. If a clergys annual compensation is 65000 and their church has designated a housing allowance of 15000 they subtract that from their salary bringing their. Is an amount paid to a pastor in addition to the salary to cover housing expenses.

Clergy housing allowance worksheet tax return for year 200____.

Managing Your Minister S Housing Allowance Pdf Expense Transaction Account

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Startchurch Blog The Must Know Facts About Housing Allowance

Housing Allowance Pastors Clergy Los Angeles California Magi

As A Part Time Minister Of Our Church I Claim The Housing Allowance On My Income W2 With My Church I Am Paided

Pastoral Housing Allowance Using Nontaxable Income To Buy A Home

Preparing A Pastor S W 2 Form Please Follow Instructions At The Top Of Each Screen To Begin The Presentation Just Press Your Down Arrow Ppt Download

Clergy Housing Allowance Exclusion Resolution

Minister S Housing Parsonage Or Housing Allowance Servant Solutions

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Assemblies Of God Usa Official Web Site Completing Irs Form W 2 For Ministers

Warnock Receives Housing Allowance From Ebenezer Offsets Senate Cap On Salary

Minister S Housing Allowance Not Income For Aca Clergy Tax Zephyr Associates Inc

Pastors Can Use A Housing Allowance To Qualify For A Home Loan Youtube

Appeals Court Upholds Federal Tax Exemption For Clergy Housing Expenses Episcopal News Service

Using A Pastors Minister S Housing Allowance To Qualify For A Mortgage Loan

Ppt Housing Allowance Powerpoint Presentation Free Download Id 1544947